Alternative minimum tax depreciation calculator

Straight line method over the same life. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Learn How To Fill The Form 6251 Alternative Minimum Tax By Individual Youtube

Married filing separately.

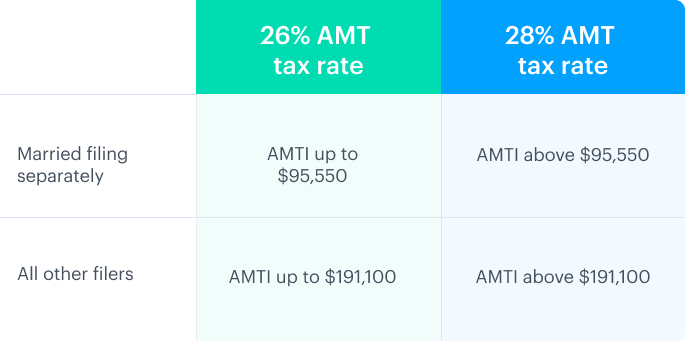

. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. The AMT has two tax rates. The ADS method must be used when making AMT adjustments.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Multiply by 15 15 x 260000 39000. However if an election is in effect to no have the special allowance apply the corporation must refigure depreciation for the AMT.

The AMT is the excess of the tentative minimum tax over the regular tax. Re-adjust the individuals income to 300000 add back the deductions. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

How Is the AMT Calculated. All people need to do is subtract this from their regular income tax depreciation and enter the result. It helps to ensure that those taxpayers pay at least a minimum amount of tax.

The alternative minimum tax AMT applies to taxpayers with high economic income by setting a limit on those benefits. Subtract 40000 or the AMT exemption amount from 300000 260000. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Use Form 6251 to figure the amount if any of your alternative minimum tax AMT. Figure out or estimate your Total Income Subtract total above-the-line deductions or adjustments to get your Adjusted Gross Income AGI Subtract additional AMT eligible deductions Add in your total ISO Exercise Spread Use that number to determine and subtract your AMT exemption if eligible to get your Alternative Minimum Taxable Income AMTI. If you claim the standard deduction you can find your AGI on line 38 of your 1040.

If tax breaks are poor policy they should be repealed directly. The AMT amount is therefore 39000. ADS is also used to compute depreciation for earnings and profits purposes.

Depreciation calculations are made for both regular tax and alternative minimum tax AMT purposes. In certain cases depreciation is required to be recalculated for Alternative Minimum Tax AMT purposes. This means that for a single person who earned more than 73600 in 2021 but less than 199900 the AMT.

Our Resources Can Help You Decide Between Taxable Vs. Multiply whats left by the appropriate AMT tax rates. The MACRS Depreciation Calculator uses the following basic formula.

If the tax calculated on Form 6251 is higher than that calculated on your regular tax return you have to pay the difference as AMT in addition to the regularly calculated income tax. Thus the AMT is owed only if the tentative. If the depreciable basis for the AMT is the same as for the regular tax no adjustment is required for any depreciation figured on the remaining basis of the qualified property.

Any other tangible property or property for which an election is in effect under 168k2Ciii to elect out of the bonus depreciation. These tax benefits can significantly reduce the regular tax of some taxpayers with higher economic incomes. To figure out whether you owe any additional tax under the Alternative Minimum Tax system you need to fill out Form 6251.

Use Form 6251 Alternative Minimum Tax Individuals to calculate your tax liability under the alternate system. Using the appropriate method for the desired assets calculate the alternative minimum tax depreciation. Using the appropriate method for your asset calculate the alternative minimum tax depreciation.

If they are sound. If you itemize your deductions which you should do before trying to figure out AMT you can find AGI on line 41 of your 1040. AMT is a separate tax that reduces the deductions of taxpayers.

How to Calculate AMT Depreciations Sapling. Depreciation Calculator has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation Section 179 deduction First Year Bonus depreciation and. Compare these to the seven federal income tax brackets ranging from 10 to 37 Which rate you pay.

Calculating the effect of AMT description for line L on the form can be relatively easy despite all the depreciation methods and classes. The Inflation Reduction Act IRA may be smaller than the proposed Build Back Better legislation from 2021 but both sets of legislation propose a reintroduced corporate alternative minimum tax AMTThe 30-year experience with a corporate AMT shows it is not a good solution. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation rate for year i depends on the assets cost recovery period.

Section 179 deduction dollar limits. The AMT applies to taxpayers who have certain types of income that receive favorable treatment or who qualify for certain deductions under the tax law. Subtract this from your regular income tax depreciation and enter the result.

Subtract any allowable non-refundable tax credits which we are assuming are 0 for our example. 150 declining balance method switching to straight line the first tax year it gives a larger deduction over the propertys AMT class life. For an alternative minimum tax example assume youve claimed 800 in depreciation on some of your business assets and the write-off is subject to AMT adjustment.

Amt Special Depreciation Allowance Ded To Be Entered And I Don T Know Where To Find The Amount In The Software Can You Help Me

What Is The Alternative Minimum Tax Amt Carta

2

The Amt Trap

R2 M4 Amt And Other Taxes Flashcards Quizlet

Alternative Minimum Tax Amt In 2020 And 2021 Money Zine Com

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

2

What Is Alternative Minimum Tax H R Block

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

The Amt And The Minimum Tax Credit Strategic Finance

The Amt And The Minimum Tax Credit Strategic Finance

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

Costa Mesa Ca Cpa Bizjetcpa

Corporate Alternative Minimum Tax Details Analysis Tax Foundation

Alternative Minimum Tax Amt Strategies Tax Pro Plus